Progression Tracker

Do You Need a Funding Plan?

Introduction to the Six Steps

Step 1: Establish Priorities

Step 2: Assess Capacity

Step 3: Set Fundraising Goals

- Creating a budget

- Calculating a fundraising goal

Step 6: Write & Implement Plan

Final Quiz

Sample Finance Plans

List of Case Studies

References & Additional Resources

Step 3 (continued). Calculating an Annual Fundraising Goal

To establish an overall fundraising goal, there are two simple methods:

- Create an expense budget and use the amount of your total expenses (plus a modest surplus) as your fundraising goal.

- Start with last year's income. Add a modest amount to allow for realistic increases in fundraising. Subtract any amount from unusual sources that you don't expect to be repeated this year (e.g. a bequest).

If you already have some expected income and simply want to calculate how much additional fundraising you will need to do, use the following formula:

- Add up all of the program expenses (both direct and indirect) from your budget, taking into account any cost reduction methods you may have employed.

- Next, calculate the guaranteed revenue for the next year. Guaranteed revenue is income that has already been secured for the upcoming fiscal year. This revenue could include multi-year grant money, interest income from an endowment, or earned income from renting a portion of your property.

- You can now calculate your fundraising goal by subtracting your guaranteed revenue from the total of your program expenses:

Additional fundraising goal = expenses (plus 5%-10% surplus) - guaranteed revenue

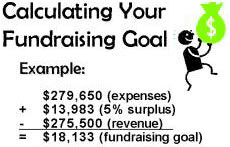

Below is an example of a calculation of an additional fundraising goal.

Example formula for calculating your fundraising goal.

Example formula for calculating your fundraising goal.

The example shows a worksheet for a sample watershed group showing costs and expenses totaling $279,650, a 5% surplus of $13,983, and expected revenue of $275,500. The answer is calculated using $279,650 (expenses) plus $13,983 (5% surplus) minus $275,500 (revenue) for a fundraising goal of $18,133.

| Calculation Worksheet | |

| Costs & Expenses | |

|---|---|

| Salaries | $109,275 |

| Taxes & Fringe Benefits | 27,550 |

| Consultants | 16,500 |

| Workshops/Trainings | 14,000 |

| Printing | 14,750 |

| Staff Travel | 5,000 |

| River Festival | 31,750 |

| Telecommunications | 10,500 |

| Postage & Shipping | 10,500 |

| Materials & Supplies | 13,125 |

| Occupancy | 13,000 |

| Insurance | 4,500 |

| Donor Recognition | 2,200 |

| In-kind Expenses | 7,000 |

| Total Expenses | $279,650 |

| 5% Surplus | $13,983 |

| Revenue & Support | |

| Foundations | $75,000 |

| River Festival | $55,000 |

| Corporate Giving/Sponsorships | $40,000 |

| Individual & Workplace Giving | $40,000 |

| Government Contracts | $34,000 |

| Fees for Service | 10,000 |

| Board Contributions | 10,000 |

| Sale of Materials | 5,500 |

| Interest Income | 1,000 |

| In-kind Donations | 5,000 |

| Total Revenue | $275,500 |

| Fundraising Goals | $18,133 |

Citation: See Resources, Works Cited #8

![[logo] US EPA](https://www.epa.gov/epafiles/images/logo_epaseal.gif)